Polestar 2025: A Defining Moment Amidst Challenges

Advertisements

As the year 2025 kicks off, the Lindholmen Science Park in Gothenburg, Sweden, becomes the focal point for Geely Holding Group's chairman Li Shufu and CEO Li Donghui. Their visit reflects a growing concern over the cooperative development of Geely's premium brands Volvo, Zeekr, and Lotus within the European market, especially with the local presence of the Polestar brand. This Swedish automotive venture, although a product of Chinese ambition, faces significant hurdles in establishing its foothold in Europe.

Polestar, once seen as the champion of a new model where high-performance Chinese manufacturing meets European sophistication, is now standing at a crossroads amid the changing dynamics of the automotive industry. Initially hailed as a success story of Geely's strategy to expand its high-end product line into Europe, Polestar faces both internal challenges and external pressures.

Starting January 15, 2025, a ban is set to take effect concerning the release of new vehicle models equipped with certain onboard communication and entertainment systems, which have been flagged for potential data security risks. This means that even vehicles produced in the United States will not be exempt, and Polestar, whose models like the PoleStar 2 are manufactured in China, faces monumental hurdles as trade tensions grow with high tariffs imposed on vehicles imported from China.

Given the U.S. government's decision to impose a 100% tariff on Chinese vehicles, Polestar’s visibility in the American market is rapidly diminishing. Local competitors such as BYD, NIO, and Xpeng have struggled to penetrate the market, and the new regulations seem tailored to isolate brands like Polestar from their target revenue stream. With Polestar’s manufacturing plan split between its South Carolina facilities and China, it seems rather unable to navigate these treacherous waters effectively.

Yet these challenges are compounded by the European Union's decision to levy anti-dumping duties on imported electric vehicles, which cuts into Polestar's profitability. While Polestar may avoid the peak tariff rate, the 18.8% duty that applies is still detrimental for a brand already positioned at a higher price point, particularly since a significant number of its sales come from the Polestar 2 produced in its Chinese facilities, thus limiting its ability to dodge these tariffs through location shifts.

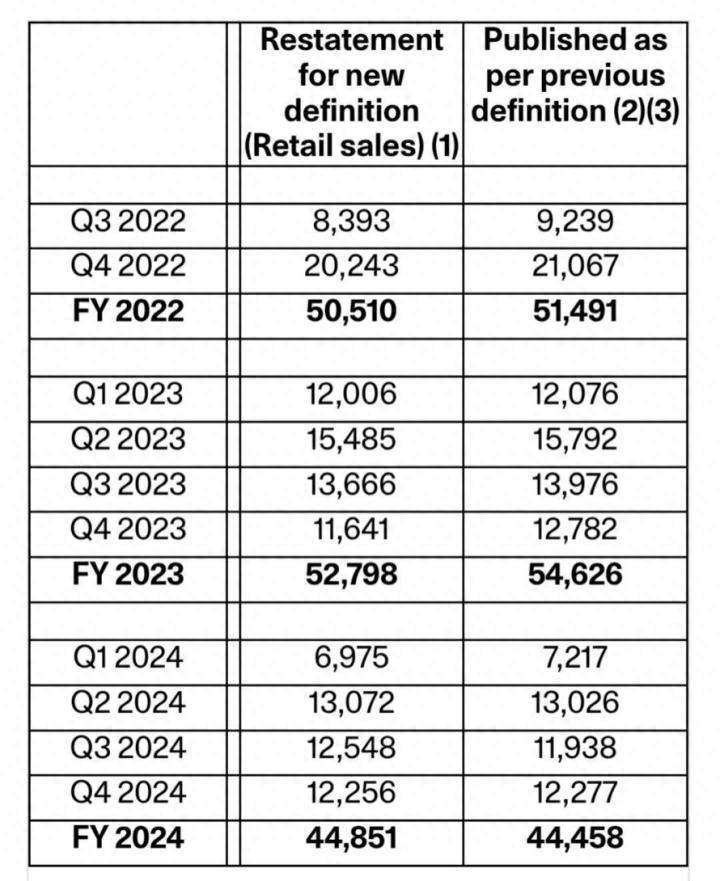

A further challenge arises as Polestar grapples with stagnating sales after its initial impressive growth. The brand's endless reliance on the Polestar 2 has backfired, as sales peaked at just over 44,000 vehicles last year, representing an 18% drop from 2023. The launch of the Polestar 3 and Polestar 4 models has been essential to tackle this stagnation; however, delays in their introduction have further complicated matters. Notably, the Polestar 3's launch was pushed back by nearly two years, reflecting an internal rift within the brand itself, particularly in its relationship with Volvo.

The original vision for Polestar, spearheaded by former Volvo CEO Håkan Samuelsson, was to market it as a premium sub-brand akin to BMW's M division or Mercedes' AMG. This would have allowed access to Volvo’s well-established R&D and production capabilities to ensure that Polestar could not only maintain but also enhance its market competitiveness. However, the evolving dynamics of relationships have introduced volatility, especially as the platforms used for Polestar’s models begin showing the strain of shared development.

Polestar and Volvo share the SPA2 platform, which also serves various future models from both companies. Unfortunately, just as software issues delayed the delivery of the Volvo EX90, the same problems have affected Polestar’s offerings, leading to heightened tensions between the two entities. This growing discord has caused Polestar’s team to rethink its production strategies, considering a further separation from Volvo's development apparatus.

While Volvo maintains a cushion with their EX30 model by leveraging Geely’s SEA platform, Polestar's struggles to sustain volume with just one competitive model have crushed previously strong sales numbers. The shared production lines have resulted in an overflow of dependence rather than a mutual benefit for both brands.

Additionally, Polestar's financial picture paints a grim outlook, mirroring the overarching issues of profitability and sustainability faced by several newer players in the automotive sector. In the first three quarters of last year, Polestar's revenue fell 21% year-on-year to $1.456 billion, and the operational loss adjusted for earnings before interest and taxes (EBIT) was chilling at $603 million—though this was still an improvement over previous counts. Any hope for immediate recovery seems clouded by a debt load exceeding $4.6 billion.

The financial strain prompted Volvo to withdraw further funding and restructure its equity holdings; their share ownership dwindled dramatically from 48.3% to just 18%, allowing Geely to consolidate more power over Polestar. This strategic shift further underscores the necessity of Polestar defining its way forward without a significant cash influx from Volvo.

Over the last year, organizational upheavals reached new heights when it was announced that Polestar would change top management roles amid this financial chaos. The exit of key figures, including the Chief Financial Officer and various directors, hinted at a major strategic overhaul, with Michael Lohscheller stepping in as the new CEO. Lohscheller, known for his meticulous approach towards cost reduction, led successful initiatives during his tenure at Opel, where he managed elegant cutbacks to streamline operations. His appointment signals a critical shift, with a focus on efficiency paramount.

Polestar aims to achieve significant cost reductions moving forward, with promising plans in place for a 25% cut in operational expenses by year-end, including further job cuts—though assurances were given that the core competencies in their Chinese teams would remain intact. Lohscheller announced in early January a vision to switch the car architecture across the upcoming fleet of models to streamline costs, suggesting a fresh approach to product development moving forth.

In the face of these challenges, the introduction of new models—a centerpiece of Polestar's revival strategy—has also taken center stage. Following the Polestar 3 and 4, the much-anticipated Polestar 5, labeled as the rival to the Porsche models, is expected to land later this year. Additionally, the forthcoming Polestar 7, designed as a competitor to the Land Rover Evoque, represents a refined segment adjustment.

As part of a broader repositioning strategy that deliberately diminishes the brand's Chinese association, Lohscheller announced plans for local production in Europe for the first time, a critical milestone for Polestar that may alleviate some of the pressures stemming from tariffs and logistical complications faced prior. The specific manufacturing site remains to be determined, with options including existing Volvo facilities in Belgium and northern France appearing as viable alternatives.

Through a rebalancing of production strategies spread across North America, Asia, and the nascent allocation of resources into Europe, Polestar appears ready to embrace diversification as a protective measure against global unrest. Furthermore, enhancing its retail strategies to complement a more robust physical presence in key markets like Germany and France is critical to boost awareness and sales projections.

Polestar envisions a doubling of its global outlet footprint by 2026—a dramatic shift from a predominantly online sales approach toward traditional dealership models that empower buyers with immediate local contact. This approach juxtaposes the earlier exclusive model of customer engagement, opening new avenues for brand growth.

Ultimately, the internal motto, “2024 is Polestar's year of transformation, 2025 is its decisive year,” encapsulates the essence of this critical path of evolution aimed at revitalizing a striking but strained brand. Without a doubt, the challenges ahead for Polestar remain formidable, but with fortitude and efficient strategy execution, the specter of success might yet loom within reach.

Leave Your Comment